Late last year, the Government of Pakistan launched the Roshan Digital Account (RDA). They’re meant to enable (and encourage) expats to send money to Pakistan legally. With those funds, you can transact locally (pay bills, send e-transfers, etc.), invest in the stock market, or purchase Naya Pakistan Certificates (NPC) and make up to 11% per annum (on PKR), or 6% on USD (!!!). If that’s not enough, the hook is a simple, quick, online-only, account opening process: fill the form, upload your docs, get a confirmation within 48 hours, and you’re set.

I have to admit: I’m not a “Naya Pakistani” but I was hooked.

Over the next five months (yes, MONTHS), I opened accounts with two banks, MCB and UBL, transferred funds, and bought NPCs.

In the following sections, I unpack my bewildering experiences with both banks, and offer product feedback.

I used to bank with MCB before I moved, so, naturally, that was my first stop.

A Google search (“mcb roshan digital account”) took me to this landing page (with lots of ‘Click here’ links), where I clicked ‘Apply Now’ (on the right) to be taken to another landing page, where I clicked ‘Apply’ to begin the process.

The first step in the application process is this progressively accessible form / gate. Enter the captcha and submit; enter your email address and request an OTP; wait up to 30 seconds to receive an email with the OTP that you enter to proceed. What’s the point of this?

The actual application starts on the next screen. It appears to be a four-step process: Create a profile, sign a few things, upload some docs, and submit.

Clicking ‘Customer Profile’ lands you in familiar territory. In addition to the usual info, this is also where you choose the type of account (‘Current’ or ‘Savings’) and the currency. The account can be opened in a range of currencies (USD, CAD, JPY, etc.) but the Naya Pakistan Certificates are only available in PKR, USD, GBP and EUR. It doesn’t say that here but you’re supposed to have done your homework.

Next up, is ‘Customer Declaration’; those forms that nobody wants to read, but has to sign. Typically, they end with a declaration that you have read the document, and agree to the terms. Not here. You can simply ‘Agree’ without even viewing the documents. The last one requires you to open it because that’s where you declare your tax residency. It’s obvious that they simply replicated the table from the paper form without any regard to usability.

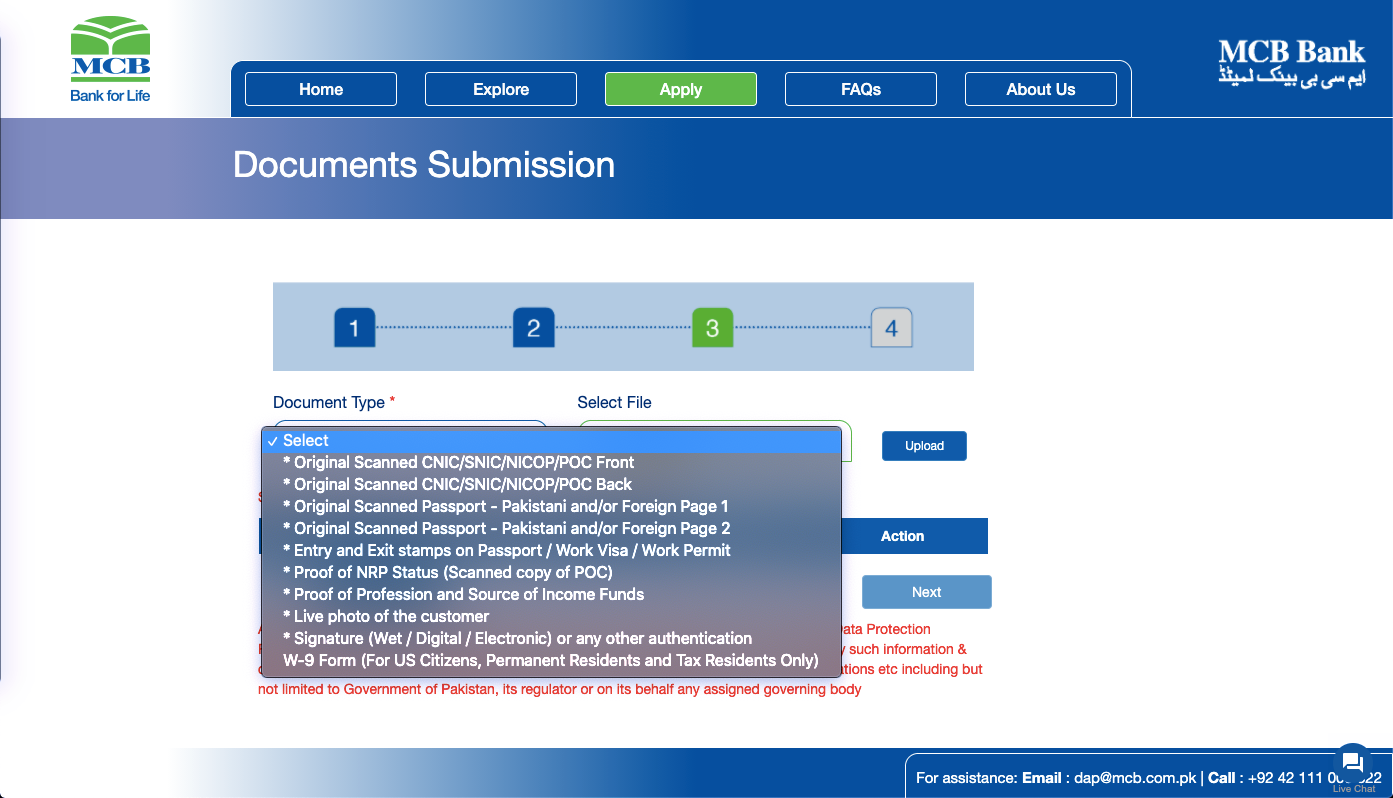

Now comes my favourite part: ‘Documents Submission’. The minimalist uploader leaves a lot to be desired.

Click the ‘Document Type’ dropdown to discover what documents are required, select the document type you’re ready to upload, select the file path, and click ‘Upload’. If your file happened to be the right size and format, it will be uploaded, and the document type will disappear from the list. If not, you’ll get an error.

Some documents like ‘Entry and Exit stamps on Passport / Work Visa / Work Permit’ have additional instructions (the “/” actually means “and”) that appear only when you choose that option. I was excited about the ‘Live photo’ but, despite the ominous prompt to ‘Allow’ the camera to operate, nothing happened; it simply let me upload an older photo. The ‘Signature’ pop-up asked me to download and sign the ‘Specimen Signature Card’, the same one that I signed when I opened my first account fifteen years ago. The signature can be ‘Wet / Digital / Electronic’ (with “/” now meaning “or”); I simply opened the PDF in Preview (on a Mac) and pasted my digital signature.

It reminded me: Fifteen years ago, I had to fake a wrist injury to update my signature because I forgot the first one I did. Now, I can just copy-paste!

Before you submit your application, you’re asked if you wish to ‘enroll for MCB e-statement facility’ with the default set to ‘No’. What?!

Firstly, why is ‘No’ the default option? Secondly, given the fact that you cannot get this far without a working email address (remember the email verification in the first step?), why even offer physical statements? If you must offer them, (given shipping costs) why are they free? And, why do I need to choose the frequency of the e-statement? Urdu translations of the options are pointless but cute, though. Will you be my shash-maahi?

Anyway, after that, you confirm your application details, submit, and get a confirmation email that your application has been received. Thus, began the promised 48 hours.

I submitted the application on October 21. I got an email the next day asking for a document I didn’t have (POC Card). There was some confusion about my visa status so they called me a few times, but always in the middle of the night (I’m on EST). Eventually, after I complained over email, they called at 9am PST, ‘verified’ some application details, we resolved the visa confusion, I explained the source of my funds, I refused to send additional documents (“They’re not required but just to add to the file”), and my account was opened a few days later. November 25, to be precise.

Product feedback: When you design an onboarding experience, you must consider ALL possible paths, not just the ‘happy path’. In this case, the happy path would work for someone who knows exactly what they’re doing, has and uploads all the right documents, and their employment situation is straightforward. Like myself, many, if not most, expat users, “immigrants” in their country of residence, will likely find themselves on the unhappy path (limited personal income, changed countries, implied visa status, expired NICOP, etc.) which will result in a phone call from a support agent.

If you’re offering this service to a Pakistani sitting in Canada, please realize that it is not the job of your customers to educate your agents on, for instance, timezones and immigration scenarios, it’s yours. In fact, map out all the ways in which customers, like myself, screw up in the process and add guidance — informational (“Did you know?”), instructional (“Only PNGs and PDFs under 2mb.”), and remedial (“NPC are only available in PKR, EUR…”) — all along the process. Help us!

Unfortunately, it doesn’t end there. Now, I had to fund the account.

I opened a USD account (6%, baby!) only to realize that my bank in the US (Capital One) doesn’t do wire transfers outside the US, and no remittance app (TransferWise, Remitly) will transfer USD-to-USD in Pakistan (because of money laundering concerns). I’m not in the US anymore so I can’t open an account with another bank. Hence, I couldn’t use the USD account.

Perhaps, MCB could’ve encouraged me to check with my source bank before I got this far?

On one of the phone calls, I had asked if they could open a PKR account as well while they were at it since I’ve already provided all the information. No, I would have to apply separately for it. Why not?!

So, on January 29, I went through the whole process again — entered the same information, uploaded the same documents — and submitted another application for a PKR account. This time, there were no phone calls or emails, and my account was opened in a day. Happy path!

The confirmation email included the IBAN and I used that to immediately wire the money from my US account using Remitly. It worked like a charm.

The next day, I tried logging in with the PIN I had been using to access the MCB ‘RDA portal’ but it wouldn’t work. I wrote to support and was told (on Feb 3): “Due to wrong pin attempts your channel has been disabled , we have forwarded your query to concern team and will enable the channel within 2 day.” There was no acknowledgement that they had actually reset my PIN when they created the new account and didn’t inform me. 🤷

Finally, on Feb 8, they responded with the new PIN, and I managed to login. The money had also arrived by then. (Three days later, completely out of the blue, they again reset the PIN. Thankfully, this time, I got an email.)

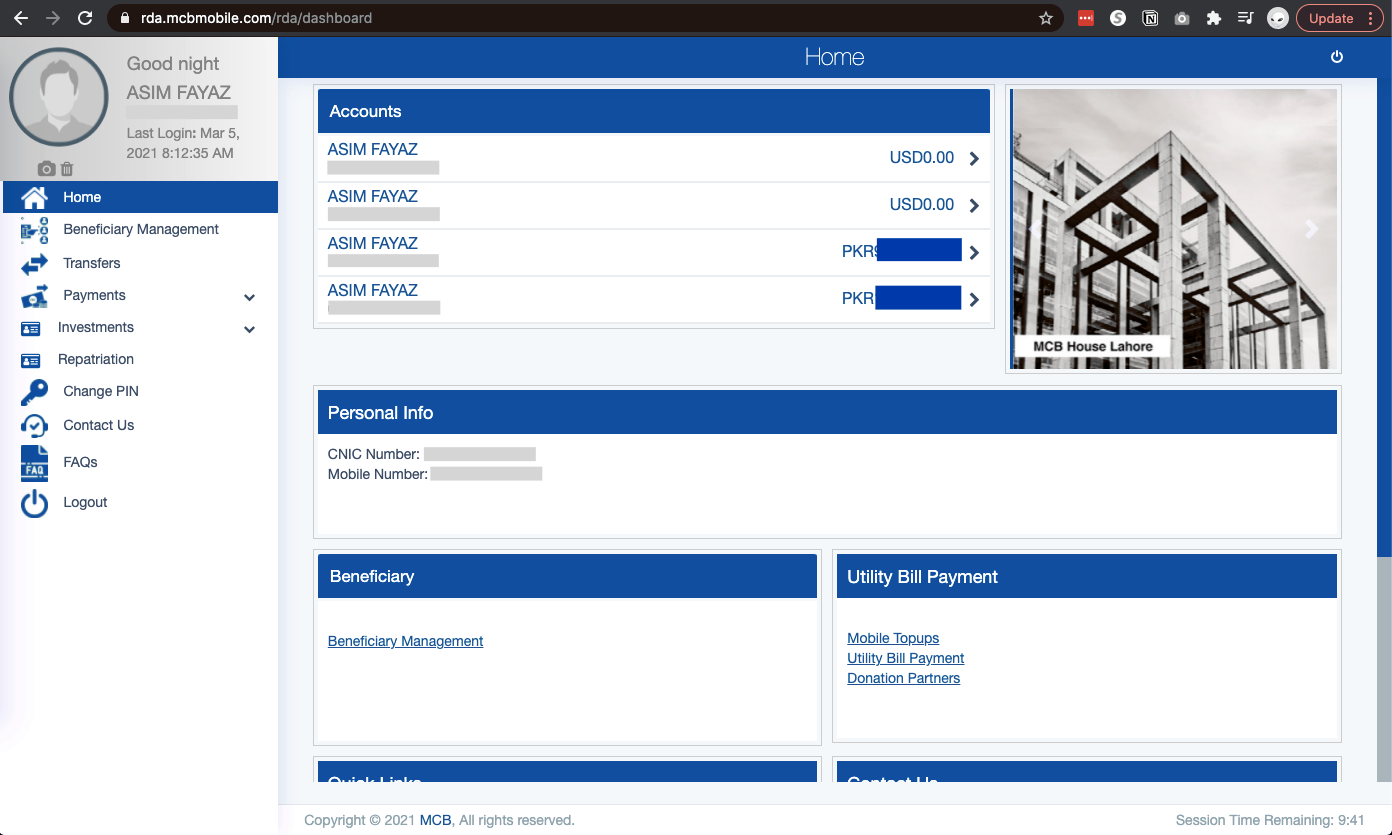

You may notice the two USD and PKR accounts each. I only opened one USD account; the other one somehow popped up on it’s own. The other PKR account, however, is the NPCs I’ve purchased in PKR.

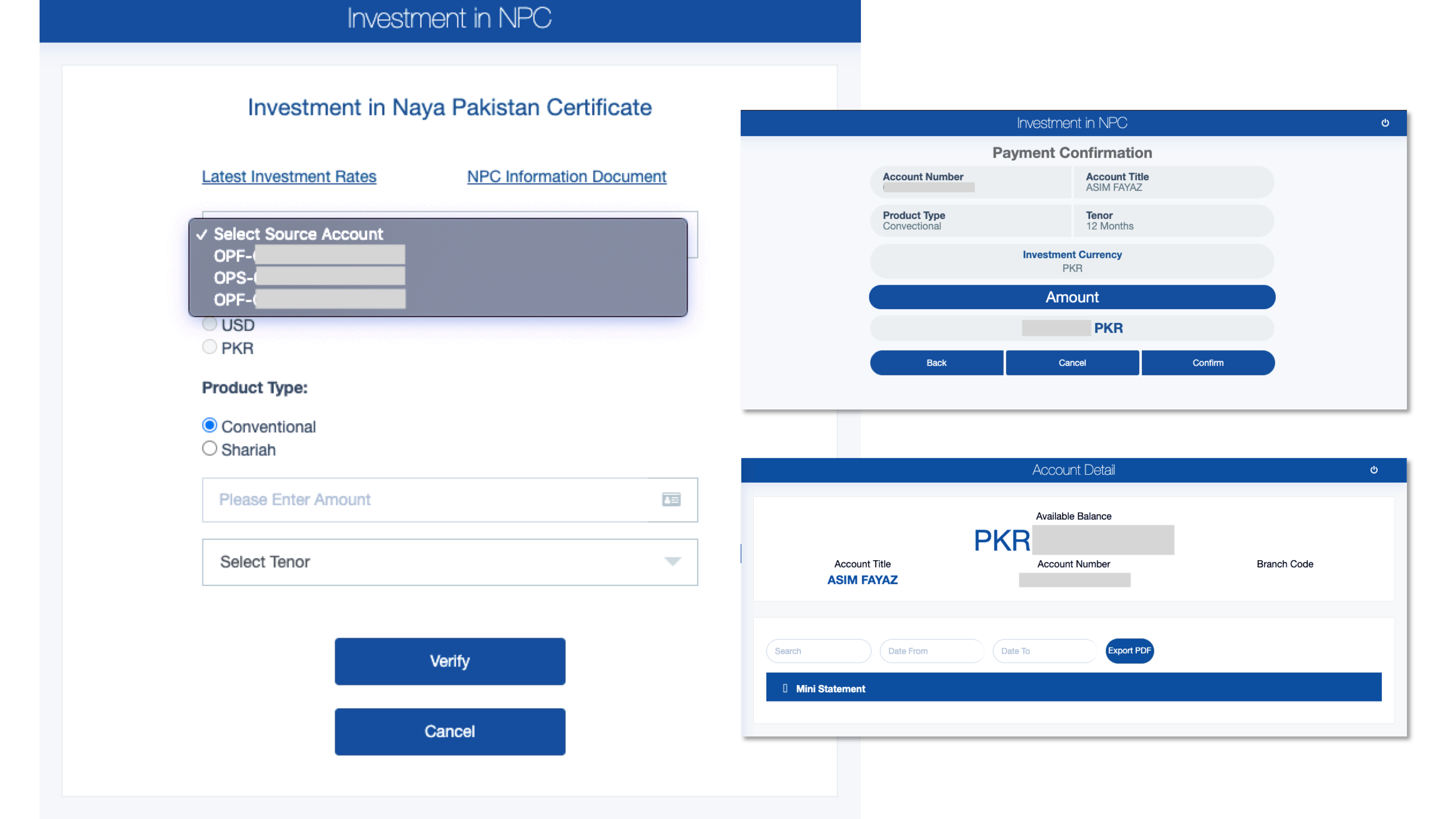

In order to purchase an NPC, you click ‘Investments’ (in the left-navigation) and then ‘Naya Pakistan Certificates’. On the purchase form (see left), First, you choose your source account (‘OPS’=PKR, ‘OPF’=USD), the currency is preselected, choose ‘Conventional’ or ‘Shariah’ (Haram or Halal? 😜), enter the amount, and select ‘Tenor’. It doesn’t show the balance for the selected account so you have to remember it from the previous screen. It also doesn’t remind you that the amount has to be at least 100,000 (for PKR) and in multiples of 10,000 beyond that. (Again, remember that!) The rate of return for each tenor (Period? Length? Duration?) is also not shown but there’s a link to the rate sheet.

There’s no ‘Submit’ button on the form. Instead, you click ‘Verify’ which checks your inputs, and takes you to the next screen (see top-left) where, I hope you notice that, the label (‘Amount’), call-to-action (‘Confirm’), and navigation links (‘Back’, ‘Cancel’), all look the same. You click ‘Confirm’ to proceed but it does not immediately result in the issuance of the NPC. Instead, you get an email stating that a booking request has been sent to the State Bank of Pakistan (SBP) for the NPC to be issued.

Interestingly, your account balance continues to include the amount you just spend on the NPC but, if you try to spend that amount, you get an error. (Again, remember!) Once the SBP issues the NPC, the amount is deducted from your main account, and credited to the NPC account (see bottom-left in previous image).

Thankfully, this final step only takes a day. The process I began on October 21, restarted on January 29, finally came to a close on February 9; a little over 48 hours.

Product feedback: My favourite product framework is called ‘Jobs to be Done’. When I set out to open a Roshan Digital Account, the job I wanted done was for someone to “grow my savings”. Everything I did — looking up RDA, reading about NPC rate of returns, comparing NPC to other investment options, opening the first USD account, providing additional documents, opening the second PKR account, transferring the funds, and purchasing the certificate — was in order for someone, in this case, MCB, to grow my savings. Similarly, someone else may be looking for a way to easily pay for their family’s bills. My job isn’t done until I’ve bought the first certificate; the other person’s job isn’t done, until they’ve paid the first bill.

Ask users what they want, reframe the customer experience from that perspective, show them how they’re progressing towards their goal, and find ways to help them along. Of course, one person can buy an NPC and pay bills, but they will likely do one before the other, and the interface doesn’t have to be exclusive to one path. Don’t design for the power user. Design for the first-time user.

Right after my disappointing experience with MCB, I took to Twitter to rant, where a friend told me that I “should’ve opened with UBL Digital”.

Thus, began the second part of this journey; UBL turned out to be equally disappointing, albeit in new ways.

Looking up “ubl roshan digital account” on Google took me straight to a beautiful landing page. But, before I could take it in, I got this popup.

Asking for “feedback on overall user experience” before I’ve even had the chance to look at the screen, let alone engage, seemed a bit extreme. Maybe this means they actually care? I closed the popup and scrolled down.

Clean design, all information is in-line (instead of “click here” links to PDFs), and, right above the fold, is the simple (smallish?) call-to-action: “Apply for Roshan Digital Account”.

Again, very simple. Start a new application, or continue an existing one.

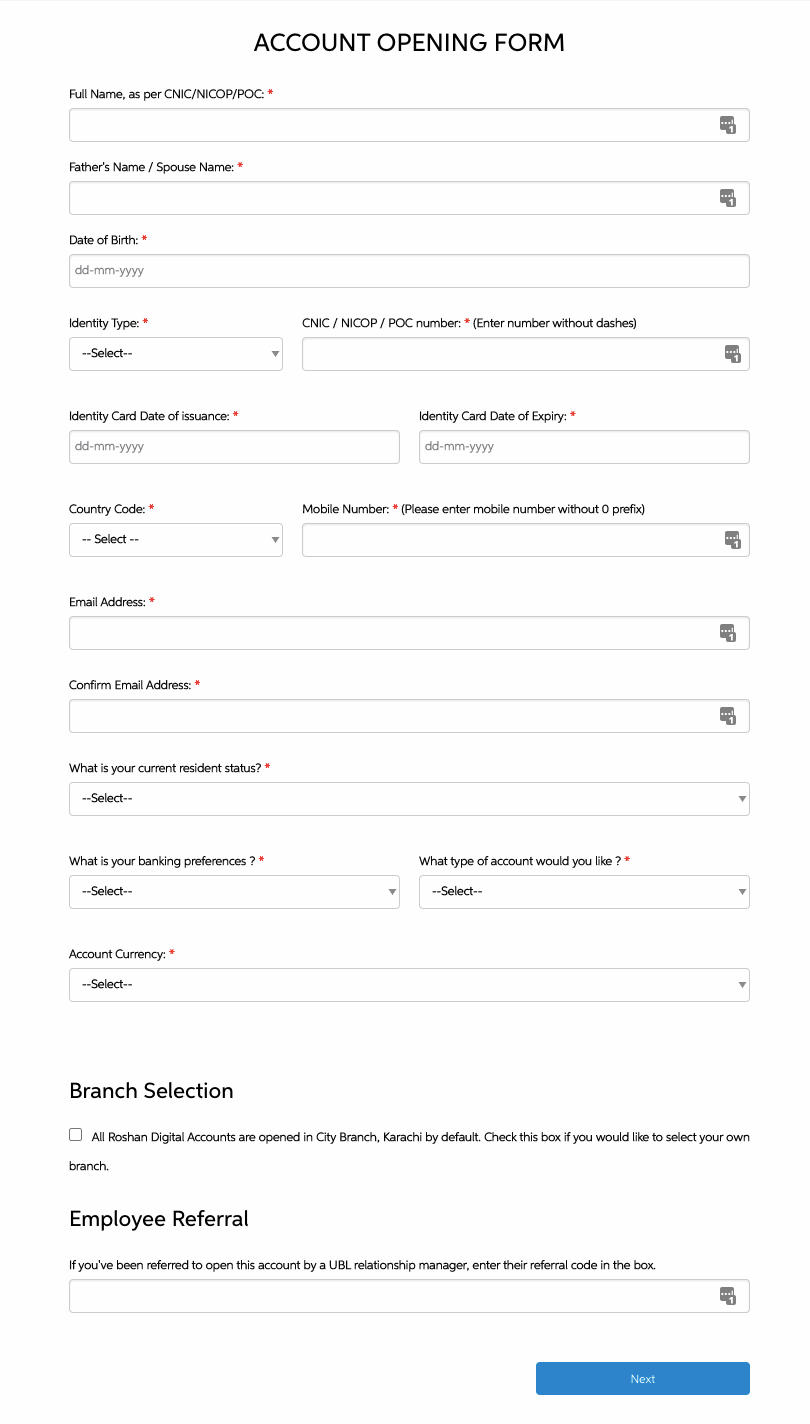

“Apply for a new application” (🤔) takes you to the Account Opening Form where you’re asked to provide the usual identification information.

You’re also asked for your banking preferences (Haram or Halal), type of account (‘Current’ or ‘Savings’), and the currency. Like MCB, they don’t remind you what currencies you can purchase NPC in, and there is no information on differences between a checking RDA and savings RDA.

Interestingly, they inform you that the account will be opened at a default branch in Karachi, but you can choose an alternate branch. What difference, if at all, would this make?

Finally, it seems like UBL is incentivizing their relationship managers to encourage their clients with overseas assets to open RDAs. Nicely done.

Next, you’re asked to verify your email address (required) and mobile number (can be skipped) using an OTP. After email verification, you’re also sent a tracking number that can be used to “retrieve” your existing incomplete application. (MCB doesn’t offer that explicitly, but, a reminder email revealed that if you leave an application incomplete, “input your NICOP and the portal will auto-populate your application details from your earlier visit.” Go figure!)

Those four sections combined, are the next (and last) step in the account opening process. It’s another looong form that, compared to MCB, requires a lot more information —source of funds, citizenship, addresses — and uploading of all the relevant documents. Finally, you sign a declaration.

Thereon, you’re met with another good-looking confirmation screen that tells you that your account has been opened, and will be activated after verification within 48 hours. Sweet!

That is when you suddenly notice the barrage of emails and SMS messages you’ve already received from UBL (with many more to come!). Whatever they email, they also text; OTPs, tracking numbers, “password to unlock Account Opening Form”. It must be costly to text? Also, ask me if I want texts?

I found the ‘Account Opening Form’ that I received over email, and unlocked with the password sent in a text, quite interesting. It appears to be a digital copy of the standard paper-based account opening form, auto-populated with much of what I had entered in the online form. As suspected, income information wasn’t mentioned anywhere; it is probably part of “due diligence” that UBL (thankfully!) chose to capture in the form, while MCB is still throwing bodies at it.

I wish I could tell you that, this time, my account was opened within the stipulated period without incident, but alas.

Product feedback: I like how the form is comprehensive; MCB ended up capturing the income-related information on the verification phone call (and asked me to send additional documents “just to add to the file”). I don’t, however, appreciate the amount of information being captured on one screen. I’m fairly tech savvy, had all the information on-hand, and was quick to navigate the fields; yet, even I felt anxious about the session timing out. The two-part form could easily have been split into smaller parts with a stepper to show progress. Also, please add some guidance! (See previous feedback sections.)

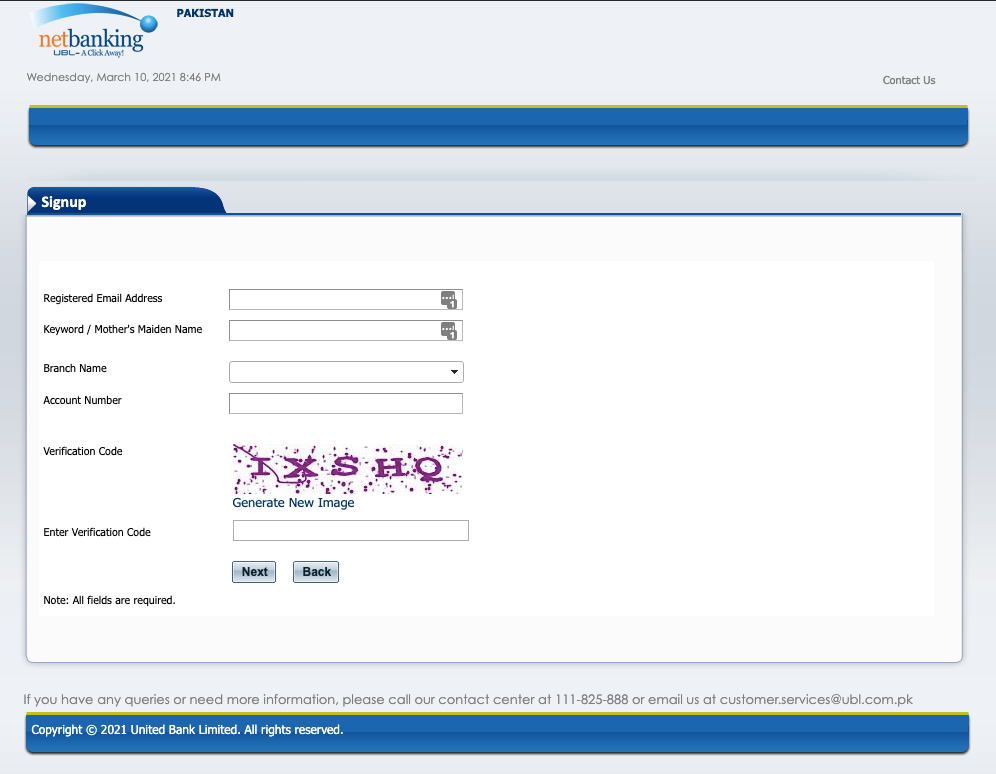

After filling all the forms, I tried signing up for ‘UBL Digital’, their online banking brand.

Even though Roshan Digital Account registration process is hosted on the UBL Digital website, opening an RDA has nothing to do with UBL Digital; you have to signup for it separately. Moreover, UBL Digital appears to be a limited facade of modern(ish) web design on ‘Netbanking’, UBL’s previous online banking brand. The facade completely fell apart the moment I clicked ‘Sign Up’. Welcome back to the 90s!

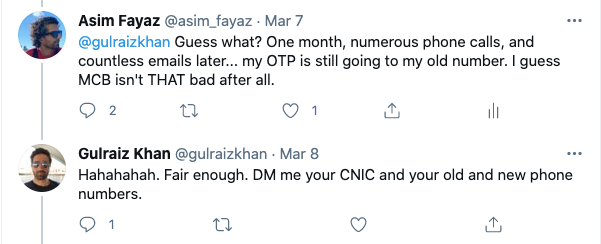

Anyway, I signed up, verified my email (again), and was about to login when I realized there’s a problem. In addition to the password, you’re also required to enter an OTP that UBL sends (only) to your phone number. The problem: The last four digits of the phone number shown were not what I had entered in the form; the OTP had been sent to my old Pakistan phone number because, I’m assuming, I had a UBL account a while ago and they still had the number on file. Apparently, it’s a known bug; love those.

I wrote to support and waited.

Two days later, I got a call at 11pm PST from a UBL agent. I was first asked to verify my mother’s maiden name which I understand to mean her full name before she got married, but I was told it means just her first name. It doesn’t. Next, I was asked to confirm if the account title is just “Asim”. I told them it’s my full name, and it’s probably a bug in their system because I had noticed the discrepancy in the auto-populated account opening form. I was told it’ll be fixed but that never happened; the account title still appears only as my first name in emails.

Finally, I was asked to send over my NICOP again because the one I had submitted was “expired”. The expiry date was still a few years ahead so it took me a few minutes to realize what they meant by expired. Turns out, I had misplaced my NICOP and got another one made; I sent a picture of the older one (which, instead of “expired”, should be considered “discarded”?) instead of the new one. Anyway, I sent the new one right away.

The next day, I got an email, and then a phone call, from another UBL agent, asking for the new NICOP. I told him I had sent it already but he said it’s not on file. I sent it again.

Five days later, I got a call from the earlier agent asking me to send the NICOP. I told her I had sent it twice already, including to her (which she didn’t remember), and mentioned the conversation with the other agent. Turns out, he was from the ‘UBL Digital’ department and he needed it to change my number, while she is from the RDA department. (🤯) Of course, I sent it again.

A few days passed before I got another email. Seems like the NICOP issue had finally been addressed because, this time, they asked for a valid visa document. My work permit is expired but I had a pending Permanent Residency (PR) application which gives me implied status. I sent back the same work permit I had uploaded earlier, along with the PR application receipt. You should be able to upload additional documents in the application itself to avoid such confusion.

Finally, on March 6, I got an email (Account Title: “Asim”) confirming that my RDA had been activated. Excitedly, I downloaded the UBL Digital mobile app, tried logging in, and realized that my phone number had STILL not been changed! 🤣

I, then, did what desis do when they give up on the system…

He got my number changed, and I managed to login. Woohoo?

The next step was to fund the account. For that, I needed the IBAN for my account. I remembered MCB had included it in account confirmation emails so I assumed UBL would have done the same. Emails from UBL, however, only have the account number. I poked around the UBL Digital mobile app but couldn’t find it there. I thought it must be mentioned somewhere in the online banking website but only found the account number, not the IBAN. I even Googled “ubl iban converter” and found one on the TransferWise website which didn’t accept the account number (so didn’t work). The official UBL IBAN Converter was useless because it asks you to pick your branch which I had no clue about (because I had gone for the default option) and, even if I did, it would have been a pain to go through the list that is sorted, not by the branch name, but the branch code!

Anyway, when that didn’t work, I went back to the app and dug around some more. Turns out, the “IBAN is there in your profile section”.

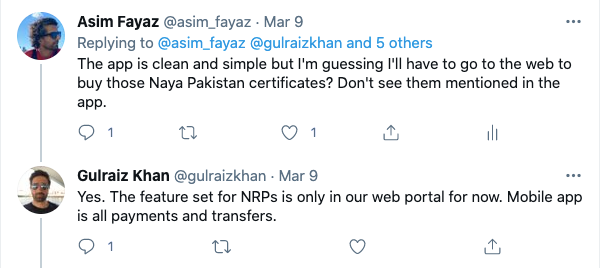

With the money in the account (in a flash!), the next (and last!) step was to purchase a Naya Pakistan Certificate. Turns out…

So, I headed back to the 90s, and purchased an NPC. It was fairly uneventful: the form shows you the rates of return, you choose the ‘Tenure’, enter the amount and a mandatory comment (“LOL”), and you’re done.

Unlike MCB, there was no confusion about the account balance not changing, or a delay between booking and purchase. In fact, as you can see, the account summary even shows you your NPC investments separately, including the rate of return and maturity date. Nicely done!

Product feedback: Throughout the process, I felt like I was talking to a bunch of disconnected departments, pretending to be a bank. I interacted with so many channels — web, email, agent, mobile, text — and it still didn’t fully work; I was eventually forced to use a backdoor, a personal connection. (I’m not the only who finds that sad.)

Firstly, the product must be able to handle users on an unhappy path (see previous feedback sections). There will always be someone who uploads the wrong document, forgets to provide some information, or ends up in a known gap in the system (old phone number). Find ways to prevent it from happening (guidance, validation); when it does happen, have SOPs ready to help users get back on track. You can throw bodies at it, but your targets users, expat Pakistanis, are not used to opening bank accounts in this manner anymore.

Secondly, even on the happy path, I would have opened the RDA with the new web interface, signed up for UBL Digital with the mobile app, looked up the IBAN in the app, transferred funds, realized I could not buy NPCs in the app, and headed to the old web interface. That is anything but seamless.

That’s it, folks.

Which bank should you go for? Given my experience with both MCB and UBL was broken, confusing, and fraught with delays (albeit in different ways), I don’t know what to say. In fact, search for “roshan digital” on Twitter and you will find that people have had similar unpleasant experiences with Faysal Bank, HBL and Meezan Bank.

Does that mean the field is open for someone to step up, put together a better user experience, and capture the expat market? Absolutely. However, the banks are probably not interested in doing that because, despite the poor experience, they’re bringing in the millions (by allegedly levering up the NPCs).

Save safe. 🤑

Originally published here.

One reply on “It’s not easy to open a Roshan Digital Account, but it can be made much easier.”

Thanks for the detailed explanation. We Pakistanis have no sense of business and it’s growth. The previous generation (currently in charge) is not interested to make any processes smooth be it banking, retail, real estate or any other business. Just look at FBR and how they are keeping the whole economy down with their ancient methods. All of them believe that the sermons given by Maulana Tariq Jameel will somehow fill the coffers of the state.